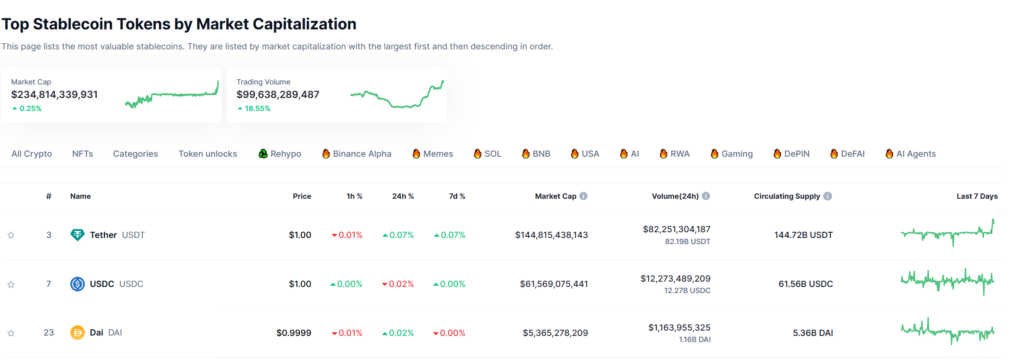

In 2025, stablecoins has evolved from a niche digital asset to a major pillar of global finance. According to CoinMarketCap, the stablecoin Market is up 63% from last year with over $225 billion and transaction volumes topping $27.6 trillion in 2024, putting them on par with giants like Visa and Mastercard.

But this isn’t just hype. Their rapid rise shows deeper shifts in how the world handles money. Institutional players are adopting them, DeFi platforms now use them, cross border payments which used to be slow and expensive are now faster, and regulations are getting clearer.

Together, These changes have put stablecoins at the forefront. What was at the experimental stage is now a requirement, as stablecoins begin to reshape everyday finance, making payments more efficient and investment opportunities more accessible around the world.

What is Stablecoin

Stablecoins are a category of crypto assets that are meant to maintain a stable value. Unlike Bitcoin or Ethereum which see large variances up and down, stablecoins are tied (or “pegged”) to something more stable. for instance, the US dollar, gold, or a mixed set of assets. This makes them a better choice for day to day payments and as a savings option.

They offer the speed, low fees, and security of blockchain, but without the wild price swings. Thus if you are sending money, saving in digital dollars, or using DeFi apps, stablecoins act like a steady bridge between regular money and the world of crypto.

What is Behind the Stablecoin Surge in 2025?

This is a question worth asking, why are stablecoins suddenly everywhere? Why are top brands and major companies starting to use them in their systems? Let’s break it down.

Market Expansion & Supply Dynamics

Between January 2024 and the end of 2025, stable coins experienced huge growth, with total supply going from $138 billion to over $225 billion which is a 63% increase.

This kind of growth is a telltale sign of very fast demand which is growing in all areas of finance from everyday transactions to large scale investments. Also what is very impressive is that stable coins had a volume of $27.6 trillion in 2024, that is 7.7% more than what Visa and Mastercard processed together.

It is very apparent that people are turning to stablecoins for what they offer in terms of speed, security and flexibility. As they continue to bridge the gap between traditional and crypto finance, stable coins are in the process of becoming a major player in the way we see money move around the world.

Adoption & Treasury Management

This year has seen big institutions coming into the digital assets space. According to a recent report from Coinbase, about 83% of investors are planning to boost their crypto holdings while 84% either are using or looking at stablecoins beyond mere transactions.

This growing confidence is a result of stablecoins ability to provide real time settlements and automated liquidity management. Even Fortune 500 companies are reported seeing results of up to 71% in cost reduction and 85% increase in terms of efficiency in treasury operations. Stablecoins are not a trend, they are in fact becoming primary tools in the financial world.

DeFi Integration & Yield Opportunities

Stablecoins are playing a major role in decentralized finance (DeFi), acting as the go-to asset for lending, trading, and earning passive income.

Platforms such as MakerDAO and Aave which rely on them to keep things running smoothly, offering users steady returns sometimes exceeding 500% during new token launches.

This kind of opportunity has caught the eye of big institutions, which include Fortune 500 companies, who are now exploring ways to tap into DeFi.

The partnership between stablecoins and DeFi is making finance more open and efficient, helping to close the gap between traditional banking and the fast-moving digital world.

Cross-Border Payments Revolution

In 2025, stablecoins are shaking up how money moves across borders, making international payments faster, cheaper, and easier. In Brazil almost 90% of crypto transactions are through stablecoins, which is a clear indicator of how useful they’ve become for sending and receiving money globally.

Even the European Union is pressing forward with their digital euro to gain more financial independence. Smaller countries like Bhutan are also getting on board, using stablecoins to grow their economy and create jobs. All of this points to a major shift that Stablecoins is the go to option for smooth, affordable, and inclusive cross-border transactions worldwide.

Regulatory Clarity & Frameworks

Regulation of stablecoins is finally coming into focus which is good for market confidence. In the EU the MiCA regulation requires that stablecoin issuers back their coins in fiat to maintain 1:1 liquid reserves and also put customer assets in a separate account thus protecting users and building trust.

Over in the U.S., the Clarity for Payment Stablecoins Act of 2023 is putting out the framework for stablecoin entry into the traditional financial system.

This is a big step forward as it puts forth better rules for which companies and users to play by which in turn makes stablecoin use safer and more transparent as they grow into a larger part of our daily finance.

Technological Interoperability & Innovation

New tech is at a point where it is greatly improving the cross chain use of stablecoins. For example Tether with the release of the USDT0 protocol has made it possible for users to see smoother and faster movement of their funds between blockchains.

At the same time, tools like BVNK’s multi currency wallet, enabling them to manage fiat and stablecoins in one place. This upgrades stablecoins into an even more feasible option for daily transactions.

By making processes faster and more seamless they are setting the stage for stable coins to become a regular part of how we send, spend, and manage money online.

Emerging Use Cases & Future Outlook

Stablecoins are finding new uses, especially in international remittances and corporate finance. Circle has issued USDC on the Aptos network, improving DeFi and payment integration on different blockchains. Moreover, Circle teamed up with SBI Holdings to launch USDC in Japan to support easier transactions across borders.

In India, Circle and the Near Foundation invested $14 million in the remittance app Abound, which has handled $150 million worth of transactions and serves 500,000 monthly users. Looking forward, a report showed that because of increased use in payments and treasury management, the stablecoin market will reach $300 Billion by 2026.