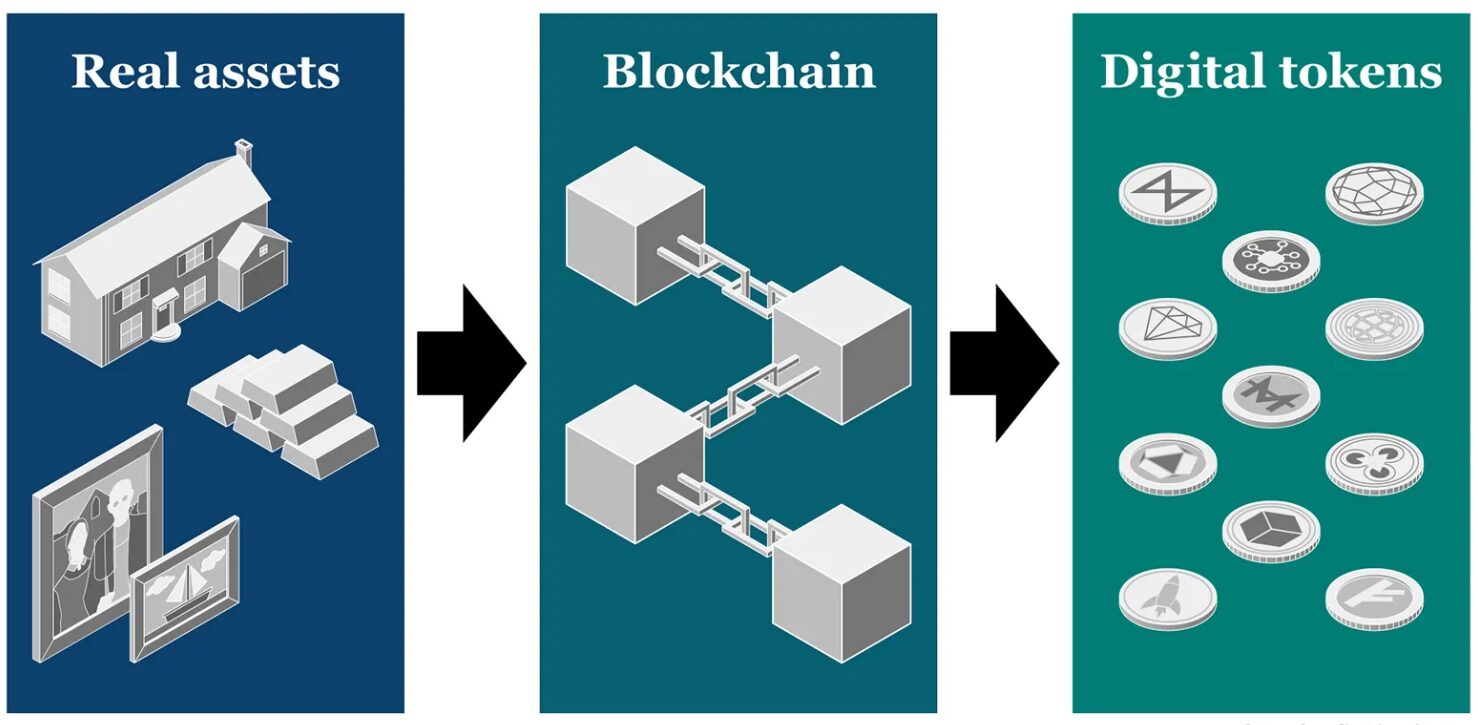

Institutional investors are breaking new ground in finance with the tokenization of real-world assets, which integrates traditional markets with blockchain technology. From real estate and fine art to private equity, asset tokenization transforms ownership by converting valuables into tradeable tokens on the blockchain.

Not only does this innovation convert physical assets into digital ones, it also increases liquidity, minimizes transaction costs, and enhances fractional ownership of high-value investments, thus making them easier to obtain.

While financial institutions globally are experimenting with blockchain-based asset management, Blackrock and Hamilton Lane have already started using tokenization to simplify investment processes. Institutional investors are preparing to gain from this digital revolution considering that the market of tokenized real-world assets is expected to reach trillions in the next few years.

What and how will tokenizing real-world assets change the investment landscape? Why is it beneficial for institutions?

Let’s analyze the shifts in the financial paradigm and the existing challenges and case studies.

What is Asset tokenization?

Asset tokenization is the conversion of real-world assets such as real estate, commodities, fine art, or even stocks into tokens on a blockchain. These tokens are tradeable and considered unique assets of value. They represent ownership and can be fractionally owned, sold, or traded, increasing the liquidity of assets throughout industries.

For instance, before now a $10 million commercial building could only ever be purchased by a handful of institutional investors, but with tokenization, the building can be split into a million tokens at a value of $10 each. Investors can now purchase shares of an asset, increasing accessibility while improving liquidity.

A case study is RedSwan CRE, a commercial real estate platform that allowed small investors to purchase stakes in real estate valued over $2.2 billion, which large institutions previously held.

Why Institutional Investors are Entering the Tokenization Market

As asset tokenization emerges as a prominent trend among traditional investors, it’s apparent that the integration of blockchain technology in finance is shifting the tides. Through the transformation of tangible assets into digitally tradeable tokens, the complexity of entry and transaction processes is being simplified, and liquidity has improved tremendously.

- Enhanced Liquidity

An increase in liquidity is the single biggest incentive for institutional investment. Historically, private equity, real estate, and high-end artwork have always been preserved and consolidated due to their intrinsic high value. Tokenization allows an investor to purchase and trade fractions of a tokenized asset, ultimately breaking down historic market barriers.

- Cost Efficiency

Another prominent reason is cost efficiency. Rather than relying on multiple stakeholders to facilitate traditional asset transfers, which increase transaction fees and take significantly longer to process, tokenized assets can be traded directly on a blockchain and facilitate peer-to-peer trading. This reduces dependency on expensive third parties while improving transparency and security.

- Regulatory Advancements

Another shift is institutional assimilation due to the asset tokenization regulations that are being continually imposed. Gradually, financial institutions are framing policies around tokenized assets, opening up the doors for large-scale investors. This is evident with enterprises like BlackRock, Hamilton Lane, and JPMorgan actively advancing towards tokenization and instilling confidence in the market.

Real-World Use Cases of Asset Tokenization

Asset tokenization is transforming multiple industries by facilitating, enhancing, and making liquidating difficult assets more effective. While still emerging, it shows the real potential of change in multiple industries.

- Real Estate.

Tokenization is enabling people to invest in real estate through fractional investment. RedSwan CRE is transforming the market by letting investors buy tokens for commercial real estate assets exceeding $2.2 billion. This process facilitates investment and makes it easier for more people to invest in real estate without restrictions.

- Private equity & funds.

Some large asset firms are utilizing tokenization to control and broaden fund use. Global investment firm Hamilton Lane has issued tokenized versions of selected portions from its private equity fund, allowing a wider audience to participate at a lower expense rate.

- Commodities.

Digital assets backed by gold Paxos Gold (PAXG) and Tether Gold (XAUT) are paradigms of the emerging commodity markets as they enable users to own portions of gold while improving liquidity and ensuring security.

- Fine Art & Collectibles.

High-pedigree art is now more accessible due to tokenization. Sotheby’s has made experiments in auctions of fractionalized digital tokens for priceless pieces of art, allowing users to own share inexpensive pieces of art.

Benefits of Tokenizing Real-World Assets

- Enhanced Liquidity

Tokenization results in the creation of tradeable units that weren’t possible before. For instance, real estate, fine art, and private equity can now be easily traded in smaller portions. The sell order for both the real estate and other investments can now be placed in months or even tokenized assets in days through a secondary market with improved liquidity.

- Greater Accessibility

Fine art, real estate, and private equity can now be traded as fractional tokens, which allows access to groups of investors that have previously been unable to reach. Those only reserved for institutional investors and ultra-high-net-worth individuals can now be accessed through tokenization and fractional selling.

- Cost Efficiency

The purchase or sale of real estate property, fine art, and private equity always involved many intermediaries, wasting time and increasing costs. Tokenization permits the elimination of unnecessary intermediaries, which results in reduced fees, faster settlement processes, and the elimination of paperwork.

- Enhanced Transparency and Security

Blockchain technology takes care of all transaction records by storing them in an unalterable ledger. This eliminates the risk of fraud and assures investors. With the help of smart contracts, compliance and execution are automated, which makes the whole transaction process more secure and efficient.

- 24/7 Market Access

Tokenized asset investors enjoy 24/7 access to the markets, unlike traditional traders, confined to specific trading hours. This flexibility gives investors more opportunities to trade.

With these benefits, asset tokenization is changing how institutional investors allocate and trade in real-world assets, paving the way for an evolving and comprehensive financial market.

Challenges and Regulatory Considerations

Although the concept of asset tokenization is efficient in several ways, it requires the attention of institutional investors due to certain obstacles and regulations that need to be resolved before widespread acceptance can be achieved.

- Regulatory Disparities

One of the most difficult tasks for tokenized assets is to get a legally formulated outline of rules that apply in different jurisdictions. Governments and financial authorities like the SEC (U.S.), FCA (U.K.), and MAS (Singapore) are still determining the proper classification, taxation, and monitoring of these assets. Differing regulations around the world create issues for institutions operating in more than one market.

- Compliance and Constitutional Liabilities

From real estate to securities, traditional assets come with a host of legal compliance mechanisms that govern ownership. It gets far more difficult, however, when these assets are tokenized since complying with KYC, AML, and investor protection measures becomes far more intricate. These frameworks are required by law, therefore, institutions must put their best foot forward in compliance.

- Smart Contract Risks

Although tokenized assets are automated and self-executed via smart contracts, vulnerabilities within the code can lead to exploits. Exploits like the Euler Finance attack of 2023 which saw the $200M loss vividly show how weak execution of smart contracts can be a bane to security. Institutions deploying tokenized assets need to conduct due diligence and ensure robust security audits are conducted before hands are put on the assets.

- Market Adoption and Infrastructure Gaps

As tokenization increases gradually, the liquidity paradox begs consideration. There is an absence of robust secondary markets for tokenized assets, which need institutional participation to foster deep and stable markets. However, integration with traditional financial systems is still a workaround, as these blockchain companies and long-established financial companies need to work alongside each other.

Future of Asset Tokenization

Despite these challenges, we expect to see the active actions regulators are taking in providing clarity, along with institutional players like BlackRock and JPMorgan who are pushing tokenized finance initiatives. With the ever-willing tokenization of assets through compliance and better security in blockchain, institutions will utilize this investment strategy globally.