In 2019, Facebook (now Meta) launched Libra, a digital currency designed to simplify, increase adoption, and revolutionize online payment. However, Libra’s growth was impacted by regulation scrutiny and government resistance to adopt the technology, leading to its downfall.

The internet has been buzzing recently after Elon Musk declared his plans to make X (formerly Twitter) an “everything app” that facilitates financial transactions much like China’s WeChat. To make this possible, Elon announced a partnership with Visa to launch a real-time payment called “X Money Account: later in 2025.

Unlike Facebook’s failed crypto experience, X focuses on traditional banking, mobile payments, and peer-to-peer transactions, making it more adaptable to existing financial systems.

One successful application is WeChat. WeChat’s launch and success in China prove that social media applications can offer more than chat rooms further to transform business, digital commerce and content monetization.

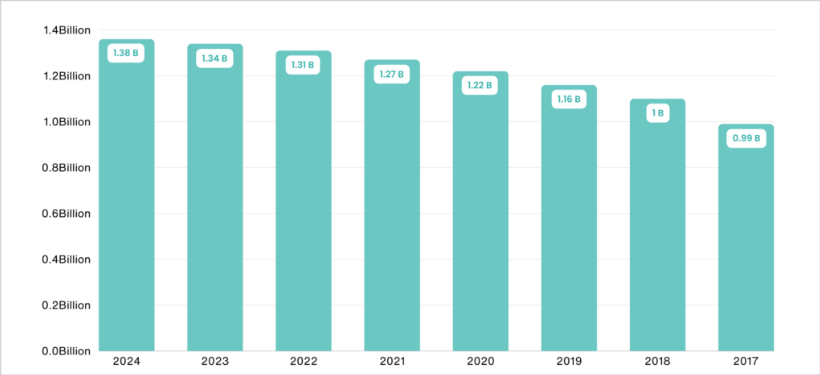

Due to the in-app services offered by WeChat, the application has grown its user base from 889 million monthly active users in 2016 to over 1.3 billion users worldwide

WeChat User base growth | Source: Demandsage

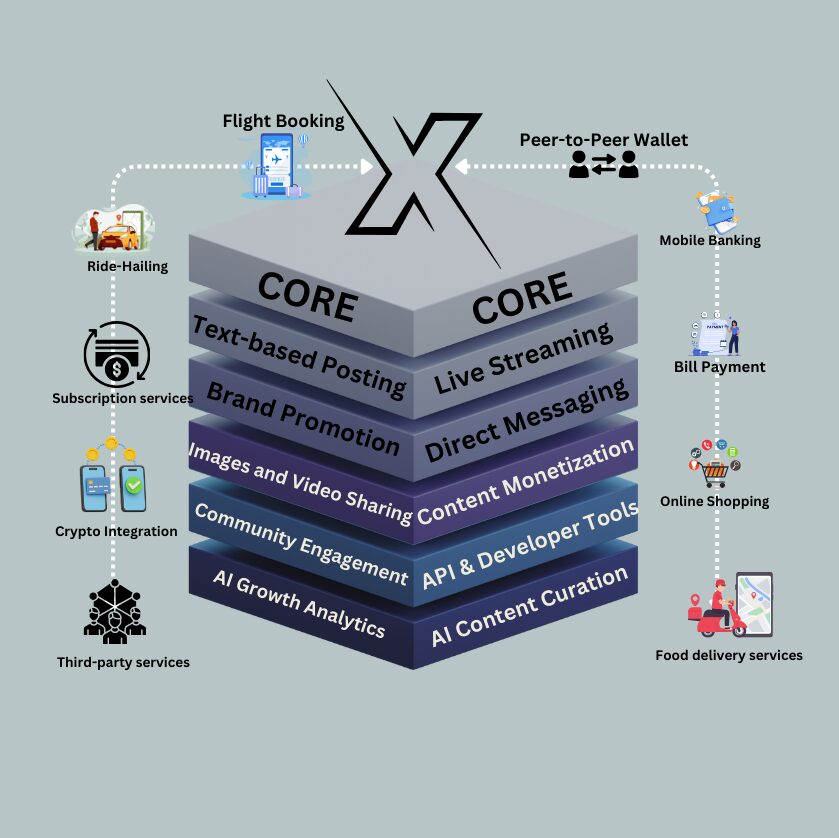

With these applications, users can chat, shop, pay bills, book services, and access other financial tools with a single tap on the screen. X aims to replicate this model in the Western market, positioning it as the go-to platform for businesses, creators, and digital media brands.

While Elon’s idea for X could streamline transactions and create a synergy between social media, digital payments and e-commerce, potentially succeeding where Facebook failed, it could also face some major challenges like user trust and competition from established players like Apple Pay and Paypal.

Understanding the concept of an “Everything App”

An “everything app” is a digital ecosystem that serves as a single entity combining multiple services such as social networking, payment, e-commerce, entertainment and many more. Instead of using separate applications for services, Everything Application presents a single application function for messaging, shopping, banking, ride-hauling, and other services.

Platforms like Facebook (now Meta) and Paypal offer numerous services as they remain separate. However, that is about to change with Elon Musk’s vision for X.

Comparison between WeChat and X’s Strategies

| Feature | WeChat Strategy | X’s Strategy |

| Messaging & Social Media | WeChat is used for instant messaging, video calls and moments (social feed). Examples: Users chat, post updates and share videos within WeChat | Text, Video, Spaces (live audio). Examples: Users engage in real-time discussion and content sharing within the app. |

| Payments & Financial Services | Users can use WeChat Pay for instant transactions, bill payments, peer-to-peer transfers and banking. Example: Users pay rent, buy groceries and pay dinner bills seamlessly | X plans to integrate mobile payments, peer-to-peer transfers and banking. Example: X could be used by businesses for payments, subscriptions, donations to events, or shopping in-app. |

| E-commerce & Online Shopping | Integrated WeChat mini-programs without the need to download or install them, users use these programs for shopping, ordering food, and booking services. Examples: Users can order Starbucks coffee, shop on JD.com, and book hotels- all within the app. | X plans to integrate e-commerce with payment. For example, businesses on X could sell their product or offer services directly via posts, and users could buy items without leaving the app. |

| Food & Transportation Services | Ride-hailing and food delivery apps operate within WeChat For example: Users can hail Didi (China’s Uber), order from McDonald’s and pay for these services with WeChat Pay | X plans to integrate ride-sharing and food delivery services. For example, X’s recent partnership with VISA will help the application with easy payment for Uber or DoorDash for in-app orders and rides. |

| Content & Creator monetization | Paid articles, tips for live streams, and other digital content within WeChat. For example, influencers can sell products through their live stream, and users can also tip content creators for exclusive content. | With X, content creators can monetize content through subscriptions, tips and paywalled content. |

| Mini-Apps & Third Party Services | WeChat hosts many mini-programs that allow users to check available balances in their bank accounts, buy movie tickets or book a doctor’s appointment. | X aims to build an ecosystem that would allow users a variety of activities, such as booking flights, managing finances or shopping, in a single interface. |

How X’s Financial Integration Will Benefit Businesses

X’s financial ecosystem could present businesses, content creators and e-commerce brands with a unique opportunity that allows these businesses to monetize within the platform, thereby eliminating external payment platforms such as Paypal or Stripe.

This will allow companies to conduct business without transaction friction. Aside from making conducting business easy, X as an everything application will allow a coordinated business structure. For example, using a single app allows businesses and users to track their products, services, money spent, the effectiveness of their advertisements, and many more.

For e-commerce brands, this means lower transaction fees, seamless in-app purchases, and a direct-to-consumer sales model that eliminates the need for third-party platforms like Shopify or Amazon. Businesses could run social commerce campaigns, where users buy products instantly from posts, live streams, or influencer collaborations.

Unlike Facebook marketplaces that rely on Paypal or Stripe, X’s idea for everything app is to enable in-platform transactions where services or products can be purchased instantly within posts, influencer promotions or live streams.

For content creators and media businesses, X could provide new revenue streams through tipping, subscriptions, and pay-per-view content. Instead of relying solely on ad revenue, creators could charge microtransactions for premium content, much like WeChat’s paid article model. Freelancers and service providers could also use X’s financial tools to receive payments instantly without needing external invoicing platforms.

By integrating banking, peer-to-peer payments, and shopping within one app, X could help businesses reduce operational costs, streamline sales, and increase customer engagement—something traditional social platforms haven’t fully achieved.

Potential Impact on the Future of Social Media and E-commerce

If X manages to add financial tools to its platform, it could change how we use social media and shop online. Picture a world where posting, chatting, and spending money all happen in one place—like WeChat does in China. This would connect what we see online with how we spend our money in new ways.

For social media, this implies that we might start spending more money while scrolling. Think about buying things straight from posts, sending money to creators you like, or paying for special content without leaving the app. This could help creators make money without relying so much on ads. However, social media might become more focused on selling things than connecting with people.

For online shopping, X could take on Amazon and Shopify by letting people sell directly through posts. Businesses might not even need their websites anymore; they could just use X to reach customers through posts, live videos, and smart recommendations. With easy payment options built right in, people might buy things more quickly and often.

But everything depends on whether people trust X and if it follows the rules. If this works, social media could become mainly about shopping, where posts and purchases go hand in hand. If it doesn’t work, it’ll show again that Western users aren’t interested in all-in-one apps. Either way, X is trying to change how we spend time and money online.

Conclusion

Elon Musk sees X evolving into a comprehensive platform that could transform how we use social media, shop, and handle money through integrated payments, shopping, and earning options all in one place. For businesses, this means reduced fees, simplified selling, and more ways to make money.

This idea has been tried before; for instance, Facebook’s project Libra (later called Diem) wanted to make its own money for people to use across Facebook’s apps. But it failed when regulators pushed back and users didn’t embrace it. X is taking a different approach, working with regular banking and payment systems that people already use instead of making them switch to something completely new.

If it works, it could change how companies and businesses reach customers, how creators make money, and how people spend online. If not, we will see reasons why super apps have not caught on in Western countries. Time will tell if X transforms digital commerce or becomes another failed experiment.